Govt. Subsidy on Solar System

Subsidy on Solar System - MNRE (Ministry of New and Renewable Energy - Central Government) has set the target to install 227 Gigawatt (22,70,00,000 kilowatt) by 31 March 2022. To achieve this target govt. is promoting solar power in many ways. Govt. of India also senctioned an amount of Rs.5,000 crore for solar subsidies only. All details and procedure to get subsidy on solar panel system is as below.

(इस पेज को हिंदी में पढ़े: सोलर पैनल सिस्टम पर सब्सिडी)

Government subsidy on solar in India

How much solar subsidy is available?

According to the latest notification by MNRE, 30% to 90% subsidy on benchmark capital cost is available for all consumers.

• 90% On Solar Water Pumping System for farmers only.

• 90% On Solar Water Pumping System for farmers only.

• 70% For 3 hill states i.e. Himachal Pradesh, Uttarakhand & Jammu-Kashmir only.

• 30% or all states of India.

Who can get the subsidy on solar?

Following consumers are able to get the govt. subsidy:

• Domestic: All residential home owners are eligible to get govt. subsidy.

• Social Sector: All the registered societies, multi-store apartments, cooperative group housing societies are eligible for subsidy on solar system.

• Institutional: All schools, colleges, institutes are eligible for subsidy.

• Non-Profit Organisations: All the non-profit organizations including old age homes, orphanage etc are eligible.

Is subsidy available on all solar panel systems?

No, subsidy is only available on made in India solar panel on grid connected systems. All following systems are eligible to get the govt. subsidy:

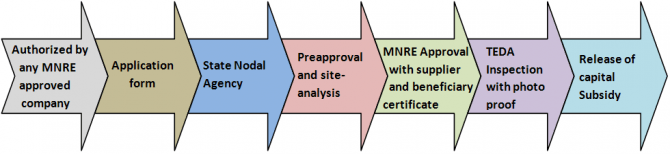

Get Quote NowProcedure to get MNRE subsidy:

Submit a project report with technical and financial details, operations and maintenance plan along with system monitoring and reporting details to MNRE. The details will be submitted through district head of your state nodal agency

MNRE evaluates your project on technical and financial points.

After your project is approved by MNRE, open tenders are invited by your state nodal agency and a channel partner will be selected from open bidding process.

Channel partner completes the installation process.

MNRE evaluates your project on technical and financial points.

After your project is approved by MNRE, open tenders are invited by your state nodal agency and a channel partner will be selected from open bidding process.

Channel partner completes the installation process.

MNRE Subsidy Process

SNA inspects your installation to ensure that only MNRE approved components are installed.

Subsidy amount is released to channel partner directly from MNRE.

Subsidy amount is released to channel partner directly from MNRE.

You will be responsible for payment of 70% of the system cost, if you choose to finance your solar plant, you may work with you bank to procure financing 70% of the system cost.

Return on investment on solar

Residential and commercial customers who are paying more than Rs.1,500 as monthly electricity bill should consider installing a grid tied solar net metering system to save their electricity bills by 20% to 30%. Look at the ROI calculator below for more details.

| Solar Plant | Solar Plant Cost | Govt. Subsidy | Cost After Subsidy | Generation/Month | Monthly Saving | Payback Period |

| 1KW solar system | Rs.75,000 | Rs.20,000 | Rs.55,000 | 120 units | Rs.960 | 4.5 Years |

| 2KW solar system | Rs.1,40,000 | Rs.40,000 | Rs.1,00,000 | 240 units | Rs.1,920 | 4.5 Years |

| 3KW solar system | Rs.2,10,000 | Rs.60,000 | Rs.1,50,000 | 360 units | Rs.2,880 | 4.5 Years |

| 4KW solar system | Rs.2,50,000 | Rs.80,000 | Rs.1,70,000 | 480 units | Rs.3,840 | 4 Years |

| 5KW solar system | Rs.3,20,000 | Rs.1,00,000 | Rs.2,50,000 | 600 units | Rs.4,800 | 4 Years |

| 10KW solar system | Rs.5,80,000 | Rs.1,74,000 | Rs.4,06,000 | 1440 units | Rs.11,520 | 3 Years |

This is an approx. estimate.

Get Latest PriceNet Metering Benefits

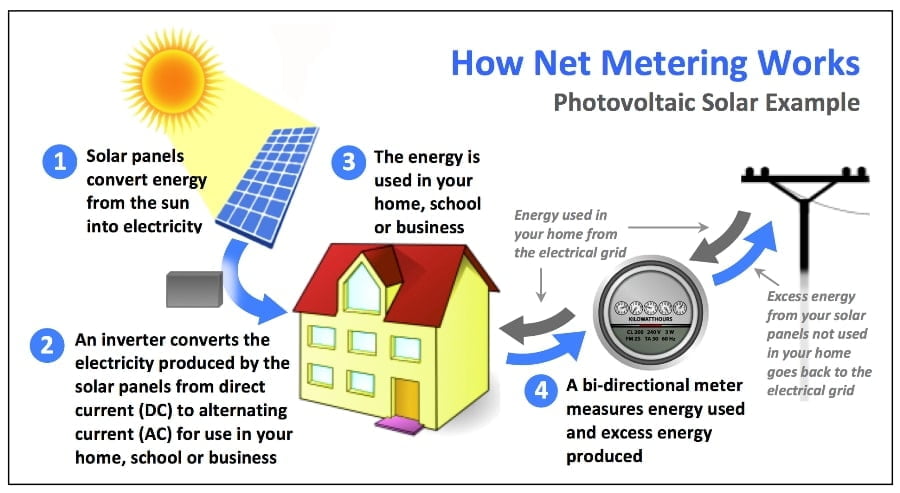

In grid connected solar photo-voltaic system, solar energy is supply in the connected load that are connected to the public electricity grid through a service connection which exports surplus energy into the grid and shortfall being drawn from the grid.

Solar net metering system explained in india

Production of surplus energy will happen when solar panel produce extra power than required energy. In this case, the surplus power is fed into the grid. During nights or when the required energy exceeds over solar energy production, it automatically drawn energy from the grid.

Accelerated Depreciation Tax Benefit

Commercial, private and industrial customers can leverage accelerated depreciation benefit, solar power generation projects have the option of profiting from accelerated depreciation benefit by the central government, as per section 32 of the Income Tax Act, 1961. Companies can use this to substantially reduce tax burden in the first few years of the project up to 100% of the project cost (80% accelerated depreciation and 20% additional depreciation)

Tax benefit on solar

Under section 80-IA of the Income Tax Act, 1961 the central government provides a 10-year tax holiday, in which the beneficiary has the freedom to choose a 10-year continuous period in the first fifteen years of the project life to avail the tax benefit. The projects are taxed by using the Minimum Alternate Tax (MAT) rate, which is significantly lower than the corporate tax rate.

The central government has mandated concessions and exemptions on specific materials imported for manufacture of solar power generation products as well as for use in solar power generation projects.

Source - Subsidy on Solar System

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Nice Blog!!

ReplyDeletePlease visit here at Atal Pension Yojana